Emergency loan applications in Nigeria have helped my family more times than I can count. Last month, my younger brother urgently needed twenty five thousand naira for his final year project, and he got approved in 10 minutes using QuickCheck.

Living in London has taught me that financial emergencies can happen to anyone. Knowing the money will be there when you need it makes all the difference.

It’s now easier and faster to get an emergency loan in Nigeria today. With more than 200 digital lenders vying for your attention, knowing which ones you can actually rely on can save you time in the crunch.

Types of Emergency Loan Situations in Nigeria

Knowing when to get an emergency loan helps you avoid a wrong approach and amount.

Medical Emergencies

Common medical emergency expenses:

- Hospital bills for unexpected treatments

- Prescription medications not covered by insurance

- Emergency surgical procedures

- Specialist consultations and diagnostic tests

- Medical equipment or mobility aids

- Travel costs for medical treatment

- Private healthcare when public options are unavailable

- Dental emergencies requiring immediate attention

- Eye care emergencies and corrective procedures

- Mental health crisis intervention and counseling

Educational Emergencies

Educational funding needs:

- School fees deadline approaching

- Examination fees and registration costs

- Final year project funding requirements

- Academic conference or research travel

- Essential textbooks and learning materials

- Laptop or technology for online learning

- Accommodation deposits for student housing

- Professional certification and licensing fees

- Career development courses and training

- Emergency relocation for better educational opportunities

Housing and Utilities

Housing related emergencies:

- Rent payments to avoid eviction

- Utility bills to prevent disconnection

- Emergency repairs for water, electricity, or gas

- Security deposit for new accommodation

- Moving costs and transportation

- Essential household appliances replacement

- Home security improvements after break ins

- Structural repairs for safety reasons

- Legal fees for tenancy disputes

- Emergency accommodation during displacement

Business Emergencies

Business emergency funding:

- Inventory restocking for critical sales periods

- Equipment repairs or replacement

- Staff salaries during cash flow gaps

- Professional services and consultation fees

- License renewals and regulatory compliance

- Marketing campaigns for time sensitive opportunities

- Technology upgrades for business continuity

- Insurance premiums to maintain coverage

- Legal fees for business disputes

- Emergency business travel and networking

Family Emergencies

Family crisis situations:

- Funeral expenses and burial costs

- Wedding contributions and ceremonial expenses

- Child birth and maternity costs

- Family reunion and celebration expenses

- Elder care and support services

- Emergency childcare arrangements

- Family legal matters and representation

- Support for unemployed family members

- Emergency travel for family crises

- Cultural and religious obligations

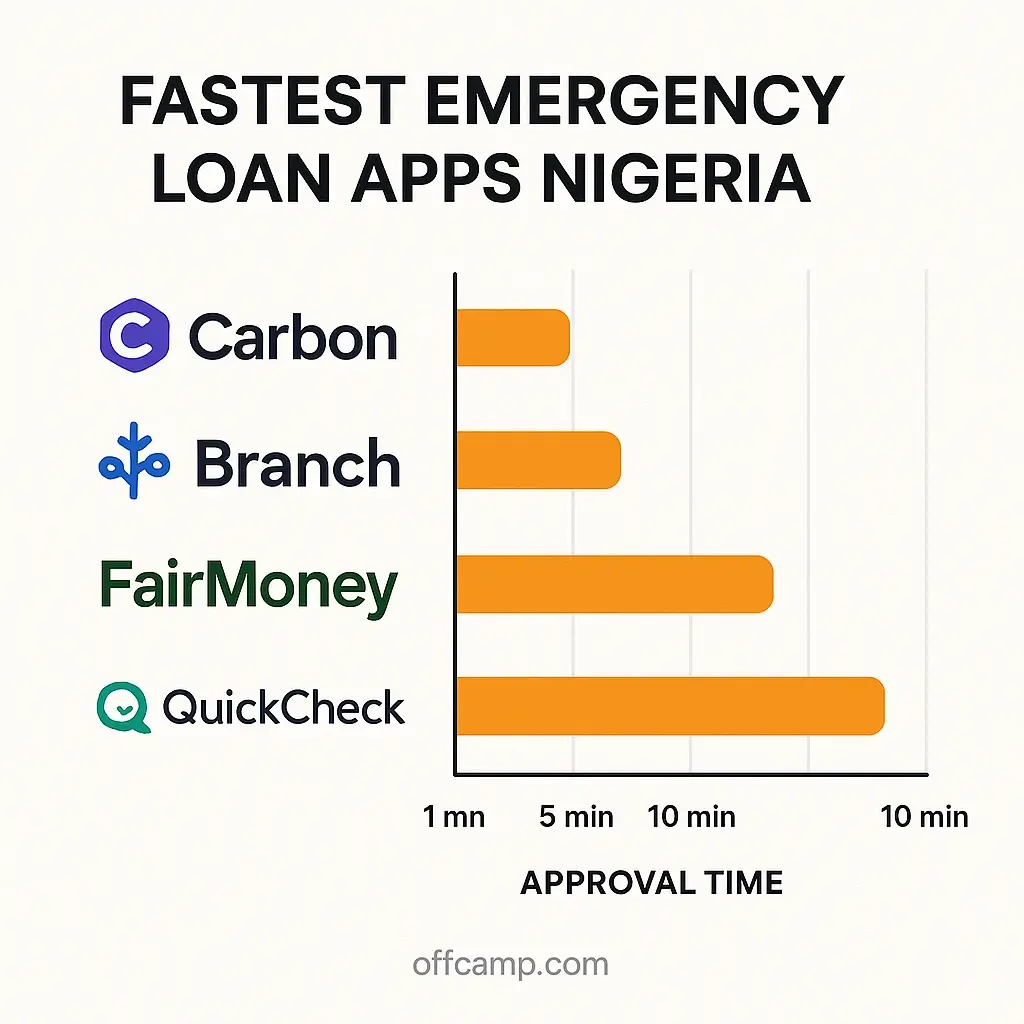

Fastest Emergency Loan Apps in Nigeria (2025)

These apps offer the fastest approval for emergency loan based on average approval time and user experience.

QuickCheck: 5 Minute Emergency Loan Approval

QuickCheck has over a million users and guarantees the fastest emergency loan approval in Nigeria.

Emergency loan features:

- Approval time: 5 minutes average

- Loan amounts: ₦10,000 to ₦500,000

- Interest Rates: 5% To 25% Monthly

- Same day disbursal guaranteed

- No paperwork required

- 24/7 application processing

- Emergency customer support hotline

- Instant credit limit assessment

- Mobile money integration available

- Flexible repayment scheduling

FairMoney: Emergency Loan in Minutes

Almost 10,000 emergency loan applications are processed daily with an average approval time of 5 minutes.

Why FairMoney works for emergencies:

- Instant decision making algorithm

- Emergency loan amounts up to ₦500,000

- Interest rates from 5% monthly

- Weekend and holiday processing

- Multiple repayment options available

- Crisis support customer service

- Integration with major Nigerian banks

- Emergency loan refinancing options

- Loyalty rewards for repeat customers

- Financial counseling for crisis management

Branch: 24 Hour Emergency Loan Processing

Branch comes in handy for quick emergency loan solutions that get processed within a maximum of 24 hours.

Branch emergency loan benefits:

- Emergency loans of ₦2000 to ₦200,000

- Uses smartphone data for quick assessment

- Check on your emergency contacts

- Crisis management loan products

- Flexible emergency repayment plans

- Weekend customer support availability

- Emergency loan refinancing options

- Community support features

- Financial education for crisis prevention

Carbon: Emergency Loan and Spending View

Carbon can help you with emergency loan and managing future emergencies.

Carbon emergency features:

- The amount of emergency loan: ₦2,500 to ₦300,000

- Interest rates varies between 4.5% to 30% depending on urgency

- Emergency expense tracking tools

- Crisis budgeting assistance

- Quick approval for existing customers

- Emergency savings recommendations

- Bill payment integration for urgent needs

- Investment options for emergency fund building

- Financial planning tools

- Emergency expense categorization

PalmCredit: Simple Emergency Loan Process

You can easily apply for an emergency loan on PalmCredit, and the requirements are not much.

PalmCredit emergency advantages:

- You can borrow up to ₦100,000

- Simple three step application process

- Emergency contact notification system

- Crisis management customer support

- Quick document verification

- Emergency repayment flexibility

- Weekend processing available

- Mobile app optimization for urgent use

- Emergency loan pre approval system

- Crisis financial education resources

Emergency Loan Amount Guidelines

It is essential to choose the right amount for emergency loans to avoid borrowing too much and facilitate rapid approval.

₦10,000 Emergency Loan Applications

Perfect for minor emergencies and urgent small expenses when you need money making apps alternatives.

Best apps for ₦10,000 emergency loans:

- QuickCheck: Fast approval, 15% monthly

- PalmCredit: Simple process, competitive rates

- Branch: Smartphone data assessment

- Carbon: Quick existing customer approval

- NewCredit: AI powered fast processing

- Xcrosscash: Credit limit activation

- OKash: Opay ecosystem integration

- WeCredit: Medium scale lending focus

- EasiMoni: Blue Ridge Microfinance backing

- Renmoney: Professional microfinance service

Common ₦10,000 emergency expenses:

- Medical consultation and basic treatment

- Essential medication purchases

- Minor home or vehicle repairs

- School fees contribution or examination costs

- Utility bill payments to avoid disconnection

- Emergency transportation costs

- Basic grocery and household essentials

- Communication bills and internet access

- Emergency clothing or personal items

- Small business inventory restocking

₦20,000 Emergency Loan Solutions

Appropriate for moderate emergencies needing slightly larger amounts.

₦20,000 emergency loan strategies:

- Apply during business hours for faster processing

- Prepare all documents before starting application

- Choose lenders with existing relationship

- Consider split applications across multiple apps

- Ensure stable income verification

- Maintain good credit history across platforms

- Use referral programs for better rates

- Apply for pre approved credit limits

- Consider emergency loan insurance options

- Plan repayment before borrowing

Typical ₦20,000 emergency uses:

- Comprehensive medical treatment

- Educational fees and materials

- Home appliance replacement

- Vehicle maintenance and repairs

- Legal consultation and basic services

- Emergency travel arrangements

- Business equipment repairs

- Family support during crises

- Professional development urgent needs

- Technology replacement for work

₦50,000 Emergency Loan Options

For significant emergencies requiring substantial funding alongside affiliate marketing income streams.

₦50,000 emergency loan best practices:

- Compare multiple lenders thoroughly

- Negotiate repayment terms carefully

- Consider collateral if available for better rates

- Explore employer loan advances first

- Check family and friend borrowing options

- Evaluate necessity versus urgency carefully

- Plan detailed repayment strategy

- Consider income increase opportunities

- Explore alternative funding sources

- Seek financial counseling if available

Major ₦50,000 emergency scenarios:

- Serious medical procedures and hospitalization

- Complete educational program funding

- Major home repairs and renovations

- Business expansion urgent opportunities

- Legal representation for serious matters

- Emergency business cash flow support

- Family crisis comprehensive support

- Professional certification and training

- Technology and equipment upgrades

- Emergency relocation and setup costs

Same Day Emergency Loan Approval Process

Use this guideline for the fastest emergency loan approval in Nigeria.

Before Applying for Emergency Loan

Preparation checklist:

- Verify your BVN is active and linked to your phone number

- Check your credit score across multiple platforms

- Gather recent bank statements (last 3 months minimum)

- Prepare employment verification documents

- Calculate exact amount needed for emergency

- Research lender reputation and customer reviews

- Compare interest rates and repayment terms

- Set up automatic repayment if possible

- Have backup repayment plan ready

- Clear phone storage for app downloads

Emergency loan application timing:

- During business hours (9AM to 5PM), responses will occur sooner

- Don’t apply on the weekends unless your lender is clear that they have 24/7 service

- Apply early in the week for faster verification

- Consider time zones if using international platforms

- Allow extra time during Nigerian holidays

- Check app maintenance schedules before applying

- Submit complete applications to avoid delays

- Respond immediately to verification requests

- Keep phone accessible for confirmation calls

- Follow up proactively on application status

During Emergency Loan Application

Application best practices:

- Provide accurate information only

- Upload clear, readable document photos

- Use stable internet connection throughout process

- Complete application in single session

- Double check all entered information

- Respond promptly to verification requests

- Keep application reference numbers safe

- Screenshot important application pages

- Note customer service contact information

- Monitor email and SMS for updates

Common emergency loan application errors:

- Providing inconsistent information across fields

- Uploading blurry or incomplete documents

- Using outdated or expired identification

- Applying for unrealistic loan amounts

- Not reading terms and conditions thoroughly

- Ignoring interest rate calculations

- Failing to verify bank account details

- Not preparing for income verification calls

- Applying to multiple apps simultaneously

- Providing false employment information

After Emergency Loan Approval

Post approval actions:

- Accept loan terms only after careful review

- Screenshot approval confirmation and terms

- Verify disbursal bank account details

- Set up automatic repayment immediately

- Schedule calendar reminders for due dates

- Note customer service contacts for future use

- Plan loan usage carefully to avoid waste

- Monitor bank account for fund arrival

- Keep all loan documentation organized

- Begin building relationship with lender

Emergency loan management:

- Use funds only for intended emergency purpose

- Avoid additional borrowing until current loan repaid

- Monitor repayment schedule closely

- Make payments early when possible

- Communicate with lender if payment difficulties arise

- Track impact on credit score

- Explore credit limit increases after good repayment

- Refer eligible friends for referral bonuses

- Consider emergency fund building for future

- Maintain good relationship for future emergencies

Alternative Emergency Loan Sources

When app based emergency loans are inaccessible, look at these options including online business opportunities.

Traditional Alternatives

Conventional funding sources:

- Employer salary advances and employee loans

- Credit union emergency loan programs

- Microfinance institution crisis loans

- Traditional bank overdraft facilities

- Family and friend emergency borrowing

- Cooperative society emergency funds

- Religious organization assistance programs

- Community development association loans

- Professional association emergency funds

- Government emergency loan schemes

Modern Alternatives

Digital funding options:

- Peer to peer lending platforms

- Cryptocurrency backed emergency loans

- International remittance advance services

- Digital wallet emergency credit features

- E commerce platform seller advances

- Freelancer platform payment advances

- Social media crowdfunding campaigns

- Online investment platform borrowing

- Digital insurance claim advances

- Mobile money emergency credit facilities

Consider exploring business ideas or profitable ventures to build alternative income sources.

Emergency Loan Repayment Strategies

A successful emergency loan repayment helps prevent crises.

Immediate Repayment Planning

Short term strategies:

- Calculate total repayment amount including interest

- Set up automatic bank transfers for due dates

- Create calendar alerts for payment reminders

- Identify income sources for repayment

- Plan budget adjustments to accommodate payments

- Prepare backup payment sources

- Monitor account balance before due dates

- Consider early repayment to reduce interest

- Track payment confirmations and receipts

- Maintain communication with lender throughout

Long Term Financial Recovery

Building financial resilience:

- Build emergency fund to avoid future borrowing

- Improve income through skills development

- Diversify income sources for stability

- Monitor and improve credit score consistently

- Learn financial management and budgeting skills

- Build relationships with multiple lenders

- Explore investment opportunities for growth

- Consider insurance for major risks

- Develop multiple emergency response plans

- Share financial knowledge with family members

You can also explore affiliate marketing platforms and investment platforms to create additional income streams.

Building Emergency Fund Instead of Relying on Emergency Loans

Creating a financial safety net reduces your dependence on emergency loan applications.

Emergency Fund Building Strategies

Systematic savings approach:

- Start with small amounts that fit your current budget

- Automate savings transfers to reduce temptation to spend

- Use separate high yield savings accounts for emergency funds

- Set realistic goals starting with ₦10,000 first milestone

- Celebrate progress milestones to maintain motivation

- Find additional income sources to accelerate fund growth

- Reduce unnecessary expenses and redirect to emergency savings

- Use windfalls like bonuses or gifts for emergency fund building

- Track progress visually through charts or apps

- Review and adjust savings goals based on changing circumstances

Income Diversification

Multiple income streams:

- Explore games that pay real money for extra income

- Consider legitimate money making apps

- Start affiliate marketing without investment

- Look into online jobs that pay daily

- Build skills for virtual assistant opportunities

- Develop content creation abilities

- Explore dropshipping business models

- Consider freelance writing or design work

- Participate in the gig economy

- Build passive income through investments

Frequently Asked Questions About Emergency Loan

QuickCheck and FairMoney are the fastest apps in Nigeria to get an emergency loan.

The emergency loan in Nigeria ranges from ₦1,000 to a maximum of ₦500,000 depending on your creditworthiness and income.

Most major applications will process emergency loans around the clock. However, bank transfers will not happen until business days.

Some apps will accept applicants who have bad credit, just expect to pay a higher rate.

Emergency loan requirements are usually BVN, Identification, Bank Statement, and proof of income.

Emergency loans typically have marginally elevated rates owing to increased urgency and expeditious processing.

Yes, those with BVN, bank accounts, and verifiable income can use it to borrow an emergency loan.

Contact your lender right away to set up payment plans and avoid further penalties.

Only make use of CBN licensed and FCCPC registered apps to protect yourself.

It’s possible, but not a good idea as it will lower your credit score and ability to repay.

Managing Multiple Emergency Loan Applications

When dealing with several emergency loan requests, proper coordination becomes crucial.

Application Coordination

Strategic application management:

- Avoid applying to multiple apps simultaneously

- Space out applications by at least 48 hours

- Keep detailed records of all applications

- Monitor credit score impact from multiple inquiries

- Prioritize apps with highest approval chances

- Maintain consistent information across applications

- Track application status and follow up appropriately

- Prepare explanations for multiple credit inquiries

- Consider staggered loan amounts instead of large single loans

- Build relationships with preferred lenders for future needs

Risk Management

Protecting your financial profile:

- Monitor credit reports for accuracy

- Dispute any incorrect information immediately

- Limit credit inquiries to preserve credit score

- Maintain employment stability during loan periods

- Keep detailed financial records and documentation

- Plan repayment schedules to avoid conflicts

- Communicate proactively with lenders about challenges

- Seek financial counseling if debt becomes overwhelming

- Consider debt consolidation for multiple loans

- Build emergency fund to reduce future loan dependency